“We’re happy with our current IT provider.”

We hear this constantly. Then we ask a few simple questions about actual security, and the responses reveal a troubling pattern: trust without verification, comfort without protection.

Being happy with your IT provider and being actually secure are two completely different things.

The Questions That Reveal Reality

When Ocean Solutions speaks with organizations about their IT security, we ask specific questions. The answers typically reveal significant gaps.

Disaster Recovery Testing: When did you last test backup restoration? How long did recovery take?

Common response: “I think they do that regularly” or “We have backups, so we should be fine.”

Reality: Untested backups fail during actual disasters when restoration takes far longer than acceptable or critical systems weren’t included.

Incident Response Planning: What happens in the first hour after detecting a breach? Who gets contacted? What systems get isolated?

Common response: “They’d handle that” or “We’d figure it out when it happened.”

Reality: No documented procedures means confusion and delays during actual attacks.

Proactive Security: What threat monitoring are you receiving? How do you identify vulnerabilities before exploitation?

Common response: “They monitor our systems” or “They’d tell us if there were problems.”

Reality: Reactive providers respond after damage occurs. Proactive providers prevent damage.

Compliance Documentation: What documentation proves appropriate controls are in place?

Common response: “They said we’re compliant” or “I don’t know what documentation exists.”

Reality: Compliance requires documented evidence that often doesn’t exist until auditors request it.

Reactive vs. Proactive – The Critical Difference

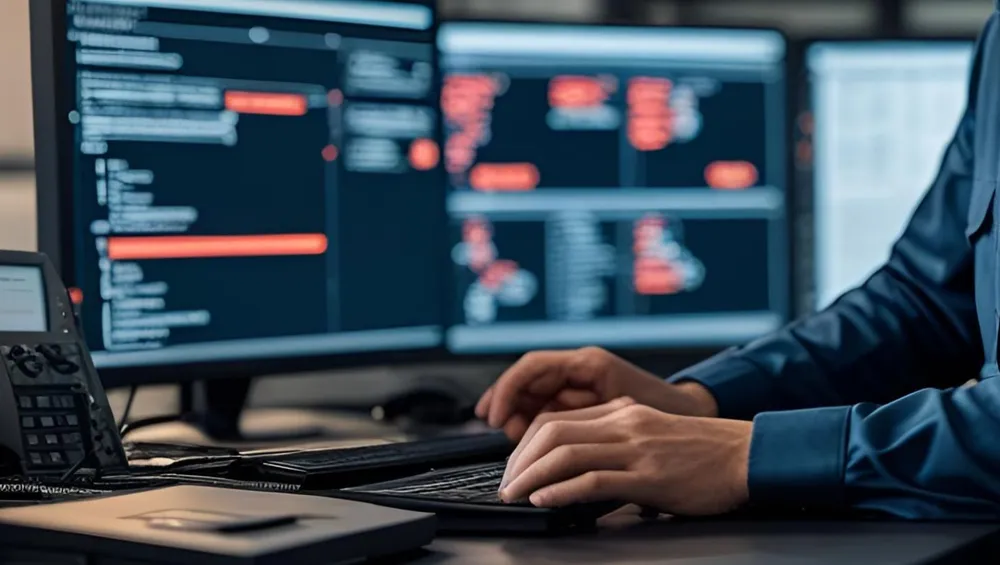

Most IT providers operate reactively. Systems go down, they restore them. Malware is detected, they remove them. This feels like good service but is actually security failure.

By the time reactive providers respond, damage has already occurred.

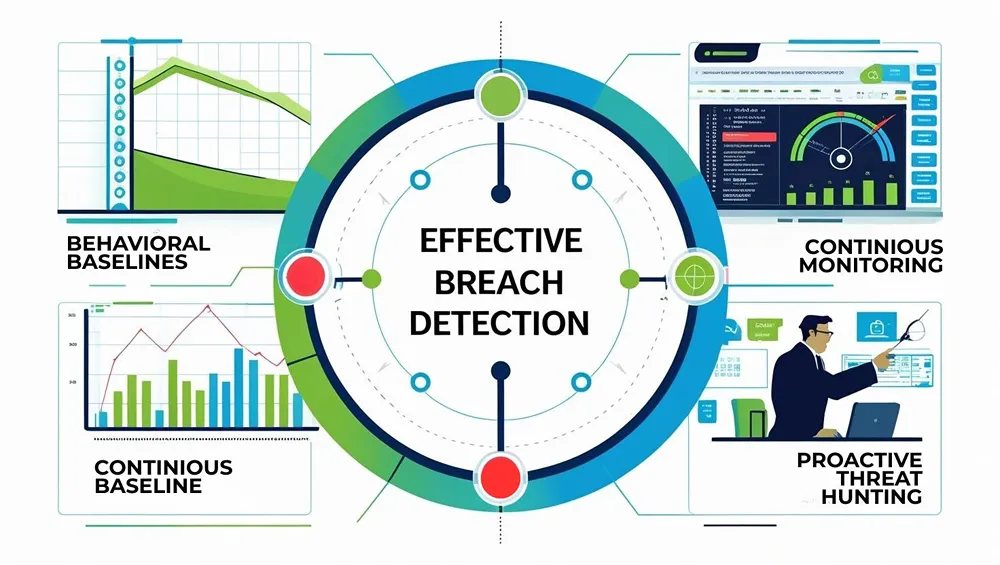

Proactive security means identifying vulnerabilities before exploitation, testing disaster recovery before disasters, monitoring for threats before breaches, and planning incident response before incidents strike.

The difference becomes obvious during the crisis you hope never comes.

The Preparation Gap

Trust-based relationships often lack necessary preparation. Organizations assume providers will handle problems when they arise without verifying preparation exists.

Then ransomware strikes and they discover: no tested disaster recovery plan, no documented incident response, no validated backups, no communication procedures.

Preparation that should have happened proactively becomes crisis management happening desperately.

Ocean Solutions tests regularly, documents thoroughly, and validates continuously so organizations are prepared before they need to be.

What Managed Security Should Actually Mean

Real managed security includes:

- Continuous monitoring that actively analyzes threats, not just collects logs

- Threat intelligence relevant to your specific environment

- Regular vulnerability scanning and remediation

- Documented and tested incident response procedures

- Compliance management with appropriate documentation

- Regular security testing that validates controls work

If your “managed security” is antivirus and reactive problem solving, you’re not getting security management.

Trust Through Demonstrated Capability

Ocean Solutions earns trust through demonstrated security effectiveness:

- Comprehensive assessments that identify actual risks

- Documented remediation plans with clear priorities

- Regular testing that validates security measures work

- Transparent reporting on security posture

- Proactive recommendations based on evolving threats

Trust develops when security effectiveness is visible, measurable, and continuously improving.

Your current provider might be trustworthy and responsive. But can they demonstrate your security actually works? Can they prove you’re prepared for incidents? Can they show documented evidence of proactive protection?

Verify Your Security Reality

Ask your provider the hard questions. Request specific answers with evidence, not vague reassurances.

If they can’t answer clearly with documented evidence, your trust may be misplaced regardless of how comfortable the relationship feels.

Ocean Solutions helps organizations verify their security reality rather than assuming trusted providers are keeping them protected.

Contact Ocean Solutions today to move from trust-based assumptions to verified security effectiveness.